Managing Stock Plan Department Risks: Uncovering the Top 3 Challenges

“Our Stock Plan Administrator is leaving the company, and I’m currently vetting options for an interim staffing solution until we can backfill the role. I anticipate we will need coverage for at least three months.”

“Hi! My Stock Plan Administrator gave her notice this week. I’m looking for some contract help to come in quickly. We are in the middle of vesting then granting for this year.”

“We are looking for a Stock Plan Administrator who can come in and handle the equity administration until we hire which could be from 3-6 months.”

These are real requests submitted by clients.

Interim stock plan administrator placement is one of the solutions we provide; however, leaders must address if they are using a band aid solution or solving the underlying problem.

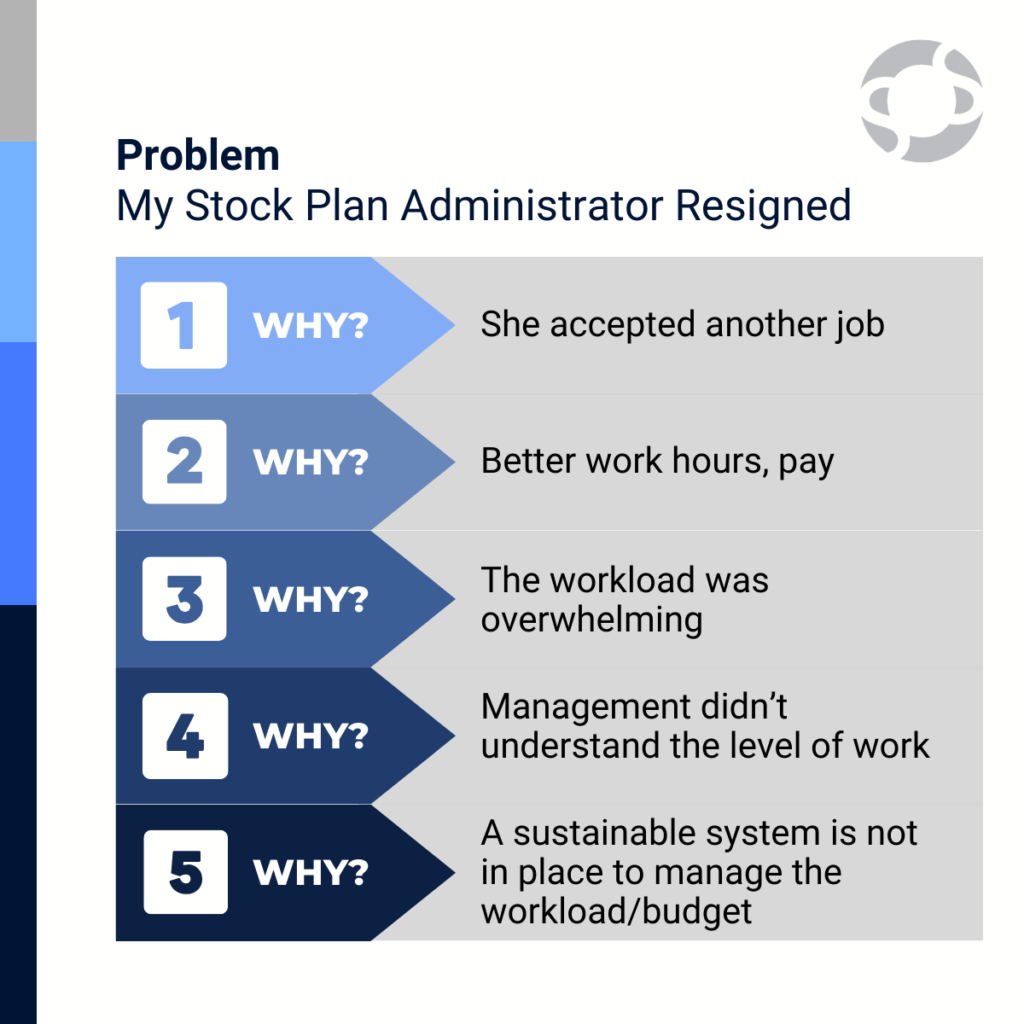

The Five Whys

Sakichi Toyoda, a Japanese industrialist, inventor, and founder of Toyota Industries, developed the 5 Whys technique in the 1930s. The process grew in popularity and Toyota still uses it to solve problems today.

The method is a simple but effective approach to get to the root cause of a problem by asking “why” typically five times. The goal is to identify the underlying causes of an issue rather than just addressing its symptoms. By repeatedly asking “why, leaders can drill down to the fundamental cause of the problem and take corrective actions accordingly.

In this scenario, the root cause was a system that was not in place to manage the appropriate workload and mitigate key stock plan department risks. Once one component, i.e. the Stock Plan Administrator, was removed, management had to scramble to create a band aid solution.

3 Key Stock Plan Department Risks

Lack of Redundancy

Stock Plan Administration redundancy refers to the practice of having multiple backup systems, processes, or resources in place to ensure continuity and reliability in operations, even if the primary components fail or experience disruption. Redundancy is an essential aspect of risk management and continuity planning.

One Stock Plan Administrator has the potential to create a single point of failure. Granted, many companies face constraints due to budget or manageable workloads, but that shouldn’t mean redundancies cannot be in place.

Documentation must be recorded to detail the processes associated with your unique plan. It involves creating written or visual representations of how tasks, activities, and workflows are performed. The importance of process documentation helps provide clarity and consistency, training for new hires, and knowledge preservation.

Unable to Scale

An effective system must be in place to handle the growing amount of work, resources, or participants in an efficient and cost-effective manner. In simple terms, scalability is the capability of the system to accommodate an increasing workload without negatively impacting performance or requiring significant changes.

When companies grow, participant management grows alongside. If a system is not in place to manage the workload, the likelihood of errors and omissions increases, which can lead to incorrect terminations, witholdings, releases, or grant audits to name a few.

Scalability is an important consideration when designing and implementing the administration of equity compensation, as it helps ensure that as workloads increase, the system can continue to provide a satisfactory level of service without disruptions or bottlenecks. The process involves making infrastructure and design choices that allow for flexible and efficient resource allocation, distribution, and management.

Absence of Risk Awareness

Managed risk is the deliberate and systematic approach taken by companies to assess, mitigate, and monitor potential risks in a controlled and proactive manner. The goal of managed risk is not to eliminate risks all together but rather manage them in a way that allows for informed decision-making, reducing the likelihood and impact of negative events, and maximize the potential for positive outcomes.

In the realm of stock plan administration, transparency, accuracy, and compliance are paramount. Mistakes may include delays in processing awards, incorrect grant calculations, or improper exercise procedures, which lead to dissatisfaction among participants. All administrative responsibilities include handling sensitive employee information and financial data. Protecting this data from breaches or unauthorized access is vital to maintain trust and prevent legal liabilities.

It is essential to be mindful of all potential reporting risks that could impact on your company’s financial health and reputation. Key aspects of managed risk include identification, assessment, mitigation techniques, monitoring and reporting, and crisis management.

To stay ahead of the curve, companies must ensure accurate and up-to-date data, routinely validating and reconciling records to prevent discrepancies. Reporting delays can cast doubt on the commitment to transparency. The team must stay abreast of changes in accounting standards, tax codes, and disclosure requirements to adhere to legal and financial requirements.

Wrap Up

Awareness to stock plan administration risks are key to operational discipline. To mitigate key risks, companies should establish a robust stock plan administration process, ensure compliance with regulations, communicate clearly with employees, regularly review plan effectiveness, and engage professional expertise as needed.

At Stock & Option Solutions, our team helps with interim placement, long-term consultants, and full outsourcing to help you navigate from short-term needs to long-term, sustainable department.

Contact us for your no-obligation consultation to see if outsourcing is right for you

Follow us: