Are you at a starting point where you need help with stock plan administration?

You might be wondering whether to hire a full-time employee or outsource the work. Both approaches have pros and cons, and the right decision isn’t always clear.

Your strategic approach should always be focused on two main questions.

1. What’s your biggest challenge?

Challenges vary depending on job function and core responsibilities. For instance, Human Resources are focused on creating an engaging workforce to increase productivity, while Finance is focused on the effects of the current economic environment, reducing costs, and increasing cash flow.

Your decision on how to manage your stock plan administration should coincide with how you plan to tackle your biggest challenge.

2. Does my decision meet the company objectives?

Making business decisions can be a daunting task, especially when there are multiple options to consider. Once your biggest challenge has been addressed, determine if your decision meets your overall company objectives. Objective analysis is an effective approach to help you make informed and rational decisions based on reliable data and measurable criteria.

The difference between in-house and outsourcing

An in-house team is your group of employees formed from people you hire to work, engage, and retain for administering equity compensation.

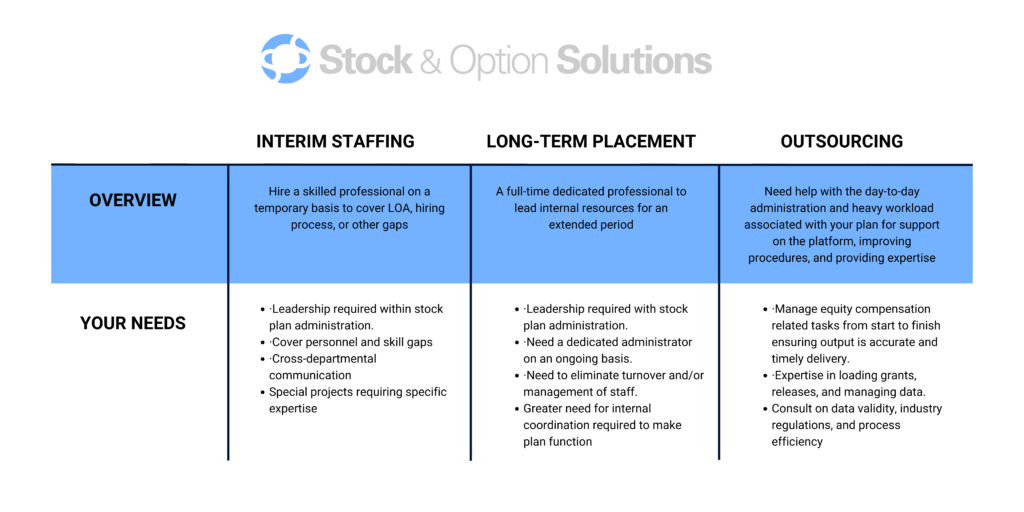

On the other hand, outsourcing refers to the practice of hiring external resources to perform specialized tasks or functions that may have traditionally been handled in-house. But there are varying degrees of outsourcing, including temporary consultants to fill a hiring gap, long-term consultants meant to replace an internal hire, or a team-based approach to absorb the workload traditionally handled by an individual.

In-House vs. Outsourcing Advantages

While both may be viable options, it’s important to know the pros and cons of each solution when it comes to stock plan administration. Here’s a simple breakdown to help compare the benefits of each.

In-House

- On-site availability: If your business requires on-site attendance, you can effortlessly interact with your team and get prompt answers to concerns.

- Greater awareness of your business: Employees understand what your company needs to operate efficiently and successfully.

- In-depth knowledge of systems: In-house employees know the systems and setups to bypass onboarding processes to administer your plan.

- Deep understanding of company culture: Your employee is well-versed in expectations, co-workers’ responsibilities, and key goals and metrics.

Outsourcing

- Access to specialized talent: Outsourcing provides the readily available, specialized talent right when you need it.

- Focus on core equity administration: You are effectively able to delegate a heavy workload so you may focus more on critical business demands and allocate resources to them.

- Cost-effectiveness: A dedicated outsourcing team has the potential to save a significant amount of direct and indirect money by avoiding salaries, hiring costs, and benefits.

- Flexibility: Building an in-house stock plan administration team takes time. Outsourcing assists in obtaining needed resources quicker while attending to your more pressing challenges.

- Faster project delivery: Subject matter experts with the in-depth, comprehensive expertise is provided while in-house talent cannot match.

Which solution is right for you?

A critical aspect of successful stock plan administration is its functionality, goals, and tying back to the overall company objectives. Creating set goals is essential to a business because it helps you measure success and foresee the longevity of your overall business objectives.

When it comes to establishing goals, you’ll need to identify the purpose of short-term and long-term goals. Here’s a simple chart to better understand needs and solutions.

The goal is to establish a long-term solution to managing equity compensation so you can focus on what you do best. One solution may solve the short-term while failing to achieve your long-term aspirations of your company. Fulfilling immediate needs while setting yourself up for the long-term is your roadmap to success.

Need Help?

At Stock & Option Solutions, our team has extensive experience creating a strategic roadmap for the long-term viability of administering equity compensation, designed to meet your unique needs.

Contact us for your no-obligation consultation to see if outsourcing is right for you.

Follow us: